10th July 2020

Are you thinking of buying or building a new home and confused about what is available? With a number of grants, schemes & concessions available NOW could be the perfect time! With as little as a 5% deposit a new home could be your reality but working out what you are entitled to can be tricky…

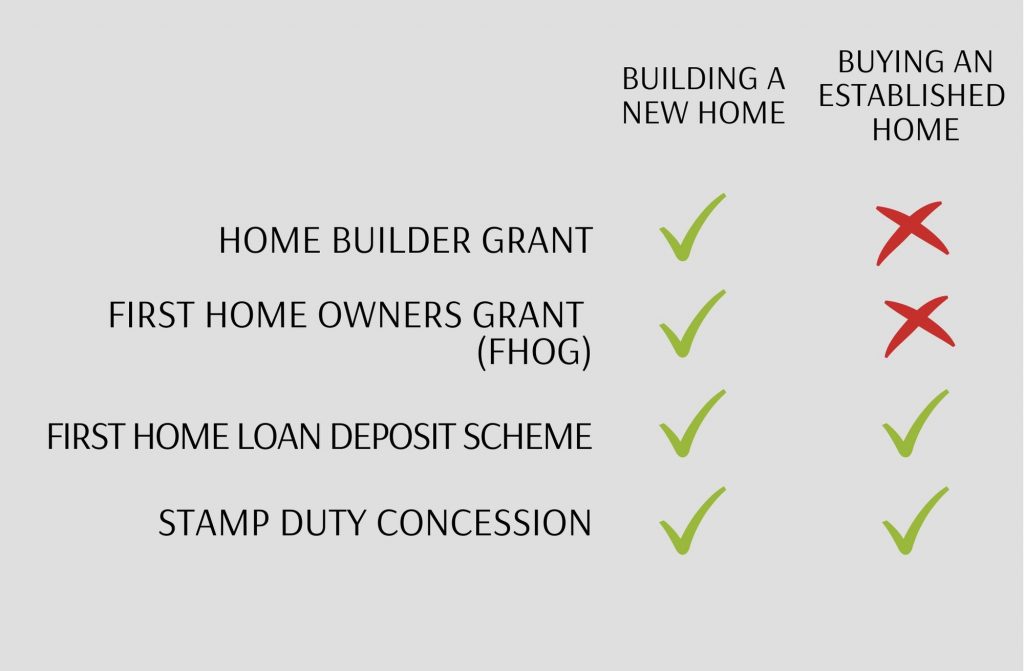

There are FOUR options currently available & what YOU are entitled to can depend on a number of factors. One of the major factors is whether you are building your new home or buying an established one.

HOMEBUILDER GRANT

This is a $25,000 tax-free grant given to eligible owner-occupiers. You do NOT have to be a First Home Buyer to obtain this grant. HOWEVER, you must be building a new home OR complete renovations worth between $150,000 -$750,000.

The HomeBuilder grant is a federal scheme designed to help the Australian residential construction market continue business in the wake of the Coronavirus.

Eligibility criteria includes:

- Individual income less than $125,000 or combined household income is under $200,000

- Sign a contract for building or renovations before 31/12/20 and build within 3 months of the date of the contract.

- The timing of obtaining these grants will be left to the State or Territory to distribute but the latest information is that these should be available once the construction starts or renovations commence

Note: Most banks at this stage are not accepting the HomeBuilder Grant as part of a deposit as they do not control the application for the grant as they do with FHOG as the funds are paid directly to the applicant. This may however change as more information comes to hand.

For more information visit the Australian Treasury website.

FIRST HOME OWNER GRANT (FHOG)

The First Home Owners grant is a one-off grant payable to first home buyers that meet certain eligibility criteria. It is designed to help first home buyers to enter the property market and is funded by the Federal Government however is managed at a State Government level.

The FHOG varies from $10,000 to $20,000 depending on which state or even region you are in. The eligibility criteria also differs between States or Territory.

Eligibility for this scheme includes:

- Each applicant is a natural person i.e. is not a company or trust.

- At least one applicant is a Permanent Resident (PR) or Australian citizen (NZ Citizens have automatic PR under Special Category Visa 444).

- Each applicant must be at least 18 years of age.

- All applicants and/or their spouse/de facto have not owned a residential property, jointly, separately or with some other person, in any State or Territory of Australia before 1 July 2000.

- All applicants and/or their spouse/de facto have not owned on or after 1 July 2000 a residential property and occupied that property jointly, separately or with some other person in any State or Territory of Australia for a continuous period of at least six months.

- Each applicant has entered into a contract for the purchase of a home or signed a contract to build a home on or after 1 July 2000. In the case of an owner-builder, laying of the foundations commenced on or after 1 July 2000.

- The total value of the property does not exceed the cap amount (Cap amount varies between states).

- This is the first time an applicant and/or their spouse/de facto will receive a grant under the First Home Owner Grant Act 2000 in any State or Territory (unless subsequently repaid).

- At least one applicant will occupy the home as their principal place of residence for a continuous period of at least six months, commencing within 12 months of settlement or construction of the home.

Please note that this criteria is current as the time that this is published. You should contact your state government to confirm the criteria for your state as it may differ. In particular the cap on the value of your property does vary between states and in some states there is no cap.

For more details visit the FIRST HOME OWNER GRANT website.

STAMP DUTY CONCESSION

Most States and Territories (Tasmania excluded) offer generous stamp duty discounts to first home buyers, regardless of whether they’re buying a new or established property.

Stamp Duty concession eligibility is similar to but not necessarily the same as the First Home Buyer schemes. For example, if someone has owned a property before but can prove that they have never lived in that property (eg. a rental property), they may be eligible for the First Home Buyer Grant, but not a Stamp Duty concession.

For more details visit here: http://www.firsthome.gov.au/

FIRST HOME LOAN DEPOSIT SCHEME

This allows first home buyers to have a deposit as low as 5% to get a home loan without paying Lenders Mortgage Insurance (LMI). When you borrow more than 80% of the value of the Land & Construction or an Established Home, lenders charge LMI. Essentially, the government will act as the mortgage insurer, guaranteeing home loans for eligible first home buyers.

Based on the Maximum Regional Price Caps, First Home Buyers can save anywhere between $10,000 and $30,000 in LMI fees.

Initially, 10,000 Scheme places will be made available for eligible first home buyers from 1 January 2020, and a further 10,000 will be made available from 1 July 2020 for the 2020-2021 financial year.

Eligibility for this scheme includes:

- Earning less than $200,000 for the 2020 income year (you will need to have your 2020 Income Tax Return and Notice of Assessment from the ATO to prove this)

- 5% in “genuine savings” – the FHOG can go toward this as well as a consistent rental ledger for 3-6 months

- Must be for owner occupied purposes only

- You build for less than the maximum regional price cap under the Scheme

For more details on this scheme (including the property price caps) visit: https://www.nhfic.gov.au/what-we-do/fhlds/eligibility/

What next…?

The easiest way to find out which of these options is right for you is to seek support from a highly qualified financial advisor. That’s where we come in! Contact us today – we live and breathe all things finance and helping you fulfill your dream of buying or building a new home is what we love to do.